FINANCIAL MANAGEMENT SERVICE UNIT

MISSION

Financial Management Services Unit (FMS) shall provide an accurate, complete, reliable, transparent and systematic financial information anchored on the institution’s standard of excellence and quality service.

VISION

To be an excellent provider of accurate, complete, transparent and reliable financial information.

GOAL

The Financial Management Services Unit aims to ensure the steady flow of funds and to maximize the use of resources of this institution through the following:

1. develop a realistic annual budget that best represents the needs of end-users.

2. coordinate the flow of funds with other departments to ensure the timing for the release of funds;

3. ensure that effective internal control system is installed to safeguard the government assets; and

4. strive for transparency to maintain the trust and confidence of the clients and other stakeholders.

FINANCIAL MANAGEMENT SERVICES UNIT

The Financial Management Services Unit comprises the consolidated functions of the Accounting Section, Budget Section and the Cashier. The unit shall safeguard the assets, check the accuracy and the reliability of the financial data, promote operational efficiency, determine the effectiveness of policies in the utilization of funds and encourage adherence to University policies and thrusts and priorities.

The financial management personnel is responsible for the efficient management of financial resources/funds of the institution.

SERVICES OFFERED

Accounting and Budget

– Financial Management Advisory Services (Budget preparation, Utilization, Liquidation, and other financial concerns)

– Payment Services (Purchase Orders, Travel Allowances, Salaries and other Benefits, Remittances etc.)

– Issuance of Certificate (Availability of Funds, Personnel Contributions, Statement of Account)

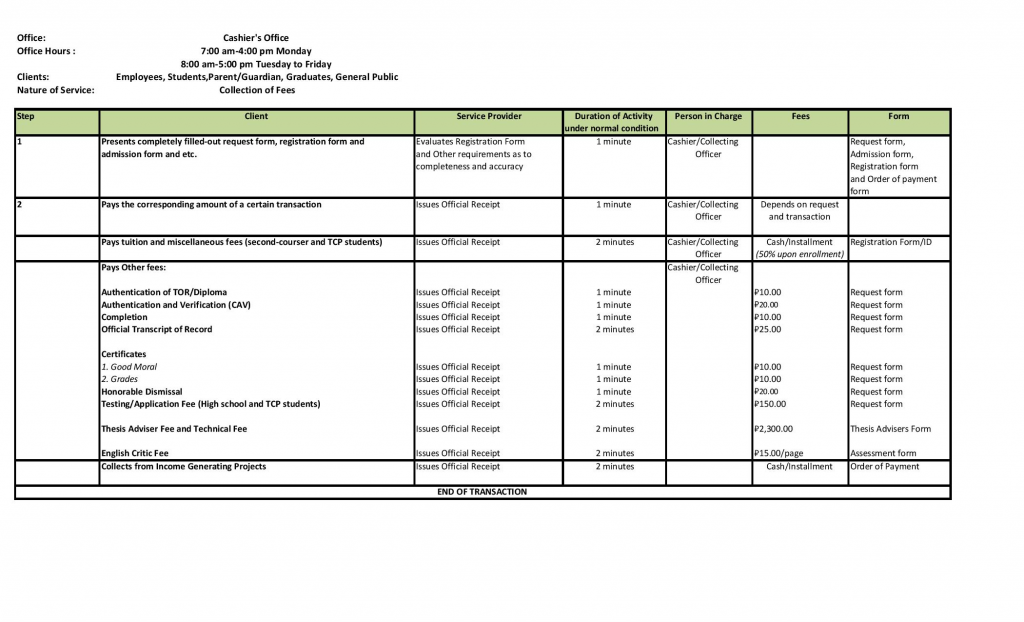

Cashier

– Collection Services (TOR, Certification, Critic Fee, Thesis Fee etc.)

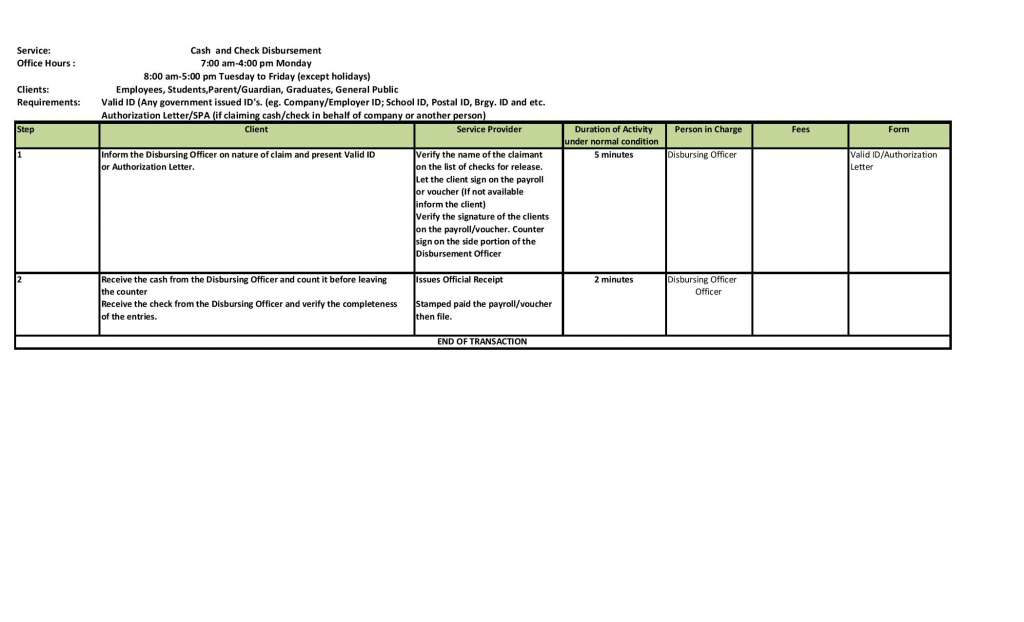

– Disbursement Services (Salaries, Allowances, Grants, and other Liabilities.)

– Issuance of pay slip.

FUNCTIONS AND RESPONSIBILITIES

Budget

– Preparation of Annual Budget

– Budget monitoring

– Issuance of Obligation Request and Status/Budget Utilization Request and Status

– Preparation of Statement of Appropriations, Allotments and Obligation report on a monthly basis

– Preparation of Financial Accountability Report on a quarterly basis

– Preparation and maintenance of Budget Registries

Accounting

– Internal Audit process

– Preparation of Disbursement Voucher

– Preparation of Journal Entry Voucher

– Processing of Liquidations of Cash Advances

– Preparation of remittances

– Preparation of Financial Reports

Cashier

– Collection of daily income

– Preparation of Check and Advice of Checks Issued and Cancelled

– Banking Functions

– Disbursement Function

– Preparation of Report of Accountability for Accountable Forms

– Preparation of Report of Collection and Deposit

– Preparation of Cash Receipt Record

– Preparation of Cash Book

– Preparation of Report of Checks Issued

– Preparation of Payslip

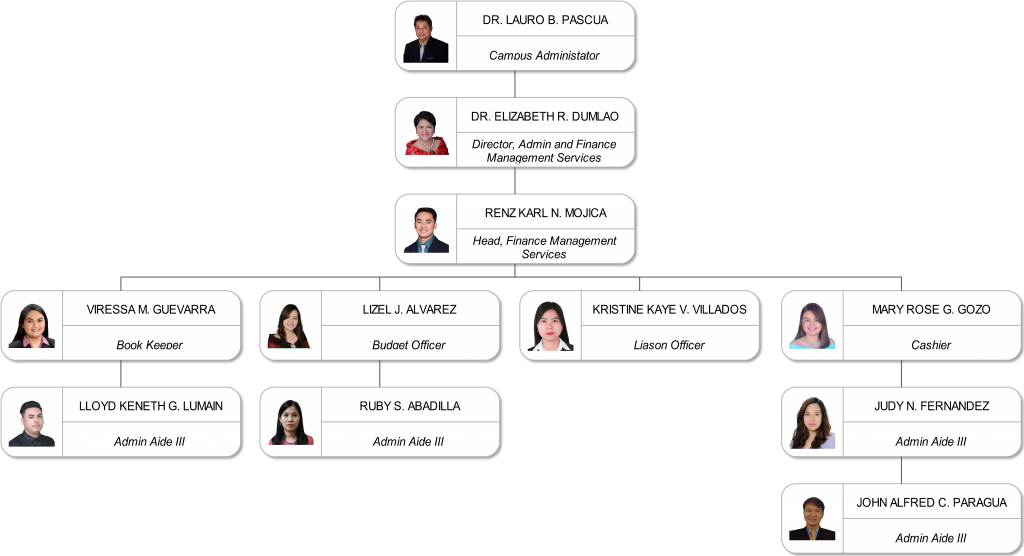

ORGANIZATION CHART

CONTACT INFORMATION

Email us at acctg.cvsur2017@gmail.com